How Does Monthly Tax Deduction Work In Malaysia. That is when working out the decline in.

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

The complete texts of the following tax treaty documents are available in Adobe PDF format.

. The deadline for tax payment is the same as tax finalization meaning no later than 90 days from the end of the calendar year. Chinas IIT law groups personal income into 9 categories. Please note that there has been a proposal to adjust the tax rate as of 2024 by introducing two new brackets.

Box 2 income is taxed at a flat rate of 269. Housing and meal allowances or their value. With effect from Wef 1 January 2022 income derived from outside Malaysia and received in Malaysia by tax residents will be subject to tax.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Income earned by a person who resided in Thailand for a total of 180 days. The Foundation is registered under Section 12A a of the Income Tax Act 1961 and is registered under the Indian Trusts Act.

In the first bracket of box 1 national insurance tax is levied at a rate of 2765. Residents are generally subject to China individual income tax IIT on their worldwide income. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions.

This tax rebate is why most Malaysia n fresh. Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Donate to Akshaya Patra save tax.

A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. You will be granted a rebate of RM400. Rob can claim the full 22 as an income tax deduction on his tax return.

Wages paid in Thailand or abroad. While donating towards Akshaya Patra you as an individual or a corporate can claim for a 50 deduction at the time of filing your income tax return. The 9 categories of.

Guide To Using LHDN e-Filing To File Your Income Tax. A basic rate of 26 for the first 67000 euros in income per person and a rate of 295 for the remainder. Donating to an NGO is the best way to gain income tax exemption.

An individual is taxed in China on ones income by category. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. School fees for dependents paid for by employer.

Conversion of taxable income If the taxable income is received in a foreign currency it must be converted into Vietnamese dong at the average trading exchange rate on the inter-bank foreign currency market published by the State Bank of. The cost of an asset that you can depreciate is reduced by the amount of any GST credit that you are entitled to. Non-residents are generally taxed in China on their China-source income only see the Residence section for more information.

Purchase of basic supporting equipment for disabled self spouse child or parent. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

Income tax in Thailand is based on assessable income. Tax rebate for Self. Tax Offences And Penalties In Malaysia.

Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay. Income attributable to a Labuan business activity of a Labuan entity including the branch or subsidiary of a Malaysian bank in Labuan is subject to tax under the Labuan Business Activity Tax Act 1990 LBATA. A 1622020 INCOME TAX DEDUCTION FOR EXPENSES IN RELATION TO SECRETARIAL FEE AND TAX FILING FEE RULES 2020 Home.

For capital assets such as machinery you may be entitled to an income tax deduction for the assets decline in value depreciation. The definition of assessable covers the following. Income Tax on Earnings.

How To Pay Your Income Tax In Malaysia.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Lhdn Irb Personal Income Tax Relief 2020

A Guide To Maximize Your Income Tax Filing In 2022

Malaysia Personal Income Tax 2021 Major Changes Youtube

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

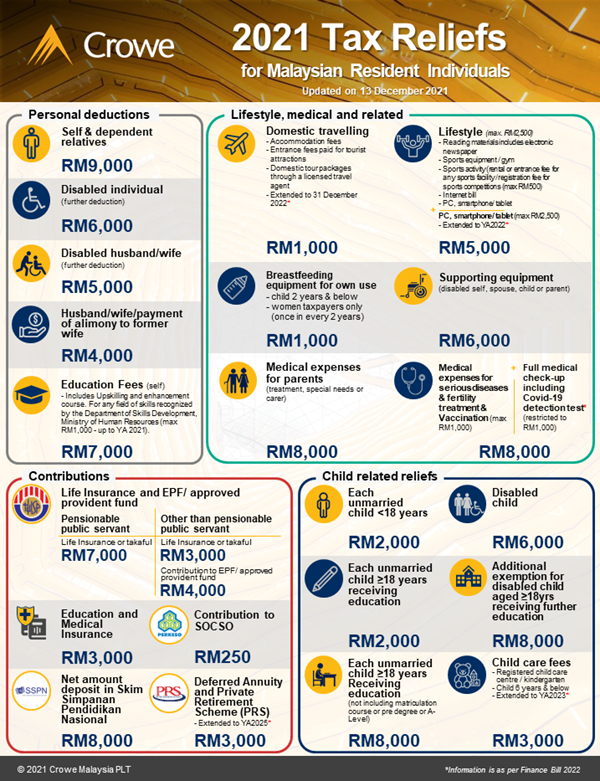

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Updated Guide On Donations And Gifts Tax Deductions

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Income Tax Breaks For 2020 The Star